If you have been following the news this year, you would have seen the doom and gloom portrayed by articles like this one and the spooky Royal Bank of Scotland’s warning “to sell everything”. Ever since last year, the financial markets have been turbulent. Naturally, many reputable media corporations have been humouring the prospect of an impending global financial crisis. While their analysis is not entirely unfounded, it is a gross exaggeration of the facts.

Sources arguing for the impending global crisis perspective cite bearish economic sentiments in the economic slowdown in China and declining commodity prices as catalysts for a looming global recession as evidence. To be fair, Shanghai Composite has fallen by 23% since the end of last year and the Chinese credit-to-GDP gap (a metric used by the Basel III protocol to assess banking stress) stands at 25.4 the highest of any country in the global economy. Commodity prices have also slumped with Brent crude oil near 11-year lows and iron ore near 7 year lows with Goldman Sachs predicting further downside to commodities in the next 18 months to come.

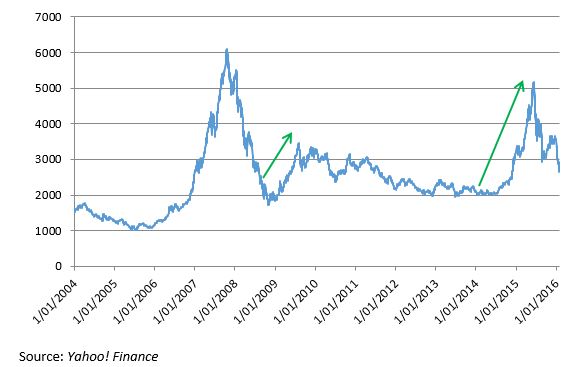

Shanghai Composite Index Rallies Occur Right Extended Crashes

While this does paint a gloomy picture for the global economy, a crash in the Chinese markets will not single-handedly translate into a global financial crisis. Jeffrey Kleintop, the chief global investment strategist at Charles Schwab Corp, remarks that, “Over the last 20 years there has been no correlation between China’s stock market and its economy, statistically it’s 0.00.”

It is also dubious whether the Chinese markets will even see a further fall in 2016. An important difference to remember is that China, unlike its Western counterparts, operates under a communist regime. This means that the reigning political party’s claim to power is dependent on its ability to control the economy. As a result, the Communist Party of China has far more incentive and unobstructed political power to prevent a crash in the Chinese financial market.

If the effects of a slowdown in Chinese growth are contained, then economies dependent on China like Australia’s are likely to have stronger fundamentals than what current market expectations suggest. Furthermore, if the Commonwealth Bank of Australia’s prediction is correct and the AUD depreciates to $0.65 USD, the Australian economy will improve as the competitiveness of Australian exports rise. With additional stimulus packages and improvements to the non-mining sector, it becomes much easier to find credence with Peter Jolly’s (the National Australia Bank’s global head of research) optimistic outlook for Australia.

The viewpoint that the global markets are heading towards a recession is not entirely supported by the data compiled from the world’s largest economies.

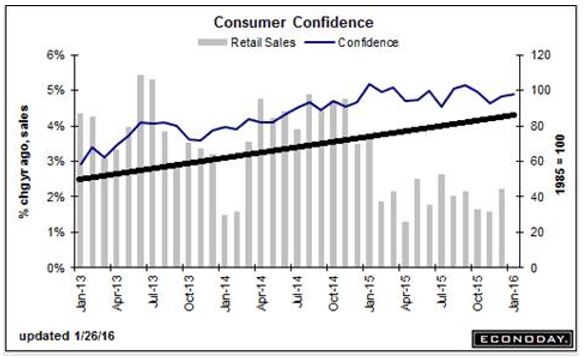

U.S. Consumer confidence, a strong “gauge” of America’s current and future spending ability is still near all-time highs. Unemployment in the United Kingdom and the United States are also sitting at near 10 year lows. While the most recent statement from the Fed has been indicative of a slowdown in the U.S. economy, it is far too early to conclude that the slowdown will precipitate a global recession.

If there is risk of significant recession, it will firstly occur in other commodity-heavy exporters like Canada and Brazil. Whereas net oil exporting countries like the US are diversified enough to insulate themselves from the slump, Brazil has been struggling with its economy projected to contract by 3% in 2016. Canada also faced a recession of its own last year in the first and second quarter with the GDP growth at -0.2% and -0.1% respectively. However, the Canadian economy is still healthy as it experienced consistent job growth and healthy consumer spending in the same time period. The announcement of further stimulus packages by the Canadian government alongside steady domestic demand indicates that the occurrence of a major recession in Canada is unlikely. As many of the major economies are exhibiting positive growth, it is unlikely that a persistent recession in these two economies will plunge the global economy into another financial crisis.

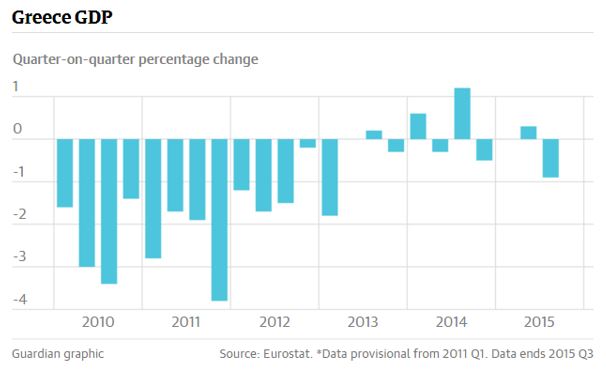

Another area that carries enough cause for concern is the Eurozone. Since the European debt crisis began over 6 years ago, the Eurozone has been mired in unmanageable debt and austerity measures. The outlook for Greece continues to look very bleak with a lack of a solution in sight.

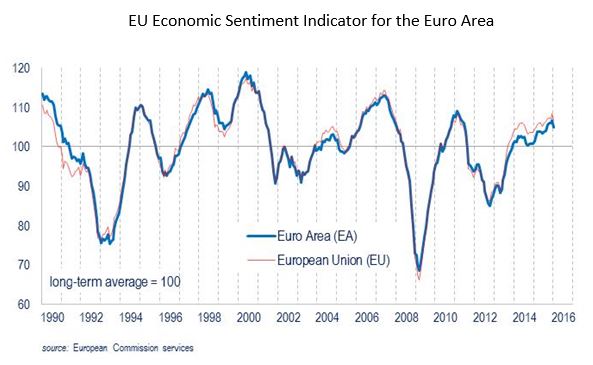

However, the situation for the Eurozone is not entirely negative as overall economic sentiment for the area is improving.

A report compiled by Ernst & Young predicts that the Eurozone will grow slowly but positively with GDP expected to grow by 1.8% in 2016 and 2017, capital investment by 2.5% in 2018 to 2019 and consumer spending by 1.6% in 2016 and 1.4% thereafter. Whether or not the economic situation in the Eurozone will worsen will mostly depend on the economies in the rest of the world. However, it is unlikely that the Eurozone will be the catalyst that will trigger a global recession in 2016.

Given the factors affecting the global economy, it is true that there are numerous challenges for the world that lie ahead. However, the risk of a global recession is low and investors should be wary about panicking too early. Lest we precipitate the very recession that we are trying to avoid. And as investors, now is a good time to be vigilant for opportunities rather than fearful.