Source: Miss Money Bee

Getting engaged may be all about food, wine, and celebration with family and friends, but planning for the future can be the direct opposite if you don’t broach the topic of financial planning with your spouse to-be.

Money may become the root cause of a number of issues and could even damage your relationship if important matters pertaining to your individual spending, saving, and investing habits are not discussed. This is why you should treat all pre-wedding finance related discussions as urgent. Developing a list of issues which require urgent and immediate attention will enable you to understand where you stand as a couple in terms of your wealth, and will also help you plan for the future in terms of investments and asset management.

Some of the aspects of financial management which you may want to prioritize above others include:

- Individual financial goals

- Balancing income and expenditure

- Deciding on a budget

- Setting up a savings or emergency fund account

- Organizing a 5-year financial plan

Your individual financial goals are possibly the most important aspect of your discussion as they will enable you to plan the other aspects of your discussion accordingly. Treat it as a starting point from which you can set limits on your expenditure. This will help you navigate smoothly through potentially tricky areas such as deciding on how much to spend on various events leading up to your wedding.

This is also a good time for both of you to be honest about where you stand in terms of your debt, credit rating, and overall financial status. There is a greater probability of you resolving your issues and balancing your financial responsibilities effectively if you are upfront about these matters from the outset of your planning discussion.

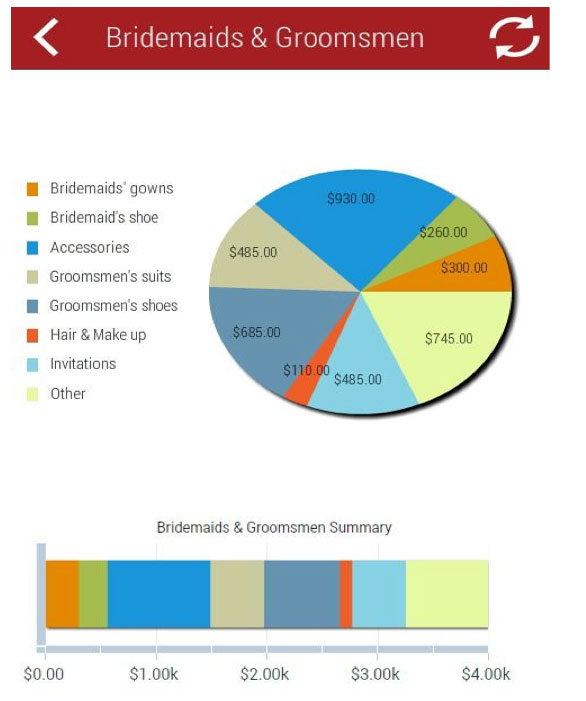

Treating your upcoming nuptials as a pilot project in context with planning finances and budgeting as a couple, will be a lesson in itself. Learning how to draw up budgets and spending plans will contribute greatly towards facilitating success in terms of achieving future saving and investment goals. There are a number of ways in which you can visualize and chart your plans in order for better clarity.

It literally pays to be on track with expenditure tracking as it will enable both of you to plan your future together and will also hasten some of your more urgent plans such as planning to have a baby or buying real estate.

Some ideas on how you can begin planning your 5 year financial plan together including making a basic list of the things you wish to achieve, and to set realistic deadlines which will enable you to remain focused. For example, if you are looking to invest in real estate within the first 3 years but are concerned about your credit rating, it is a good idea to begin balancing it from year 1 in order to achieve a positive rating by the third year.

Another method which is sure to keep you and your spouse on track with your budget and goals is to use one of many online financial planning services which are available in the form of actual consultants who will guide you, or applications which will enable you to chart your financial journey through pie charts and graphs.